The Best Guide To Payday Loans

Wiki Article

Not known Factual Statements About Quick Payday Loan

Table of ContentsThe 7-Second Trick For Payday Loans7 Simple Techniques For Quick Payday LoanSee This Report about Payday LoansThe Of Payday Loan

Your employer might deny your request, however it's worth a shot if it suggests you can prevent paying exorbitant fees and interest to a cash advance lending institution. Asking an enjoyed one for aid may be a challenging conversation, but it's well worth it if you have the ability to prevent the extravagant rate of interest that comes with a cash advance. Payday Loan.Ask your loan provider a lot of inquiries and also be clear on the terms. Plan a settlement plan so you can pay off the loan in a timely way as well as avoid becoming overwhelmed by the added expenditure. If you recognize what you're getting into and what you require to do to leave it, you'll settle your funding much more rapidly as well as lessen the effect of outrageous rates of interest and fees.

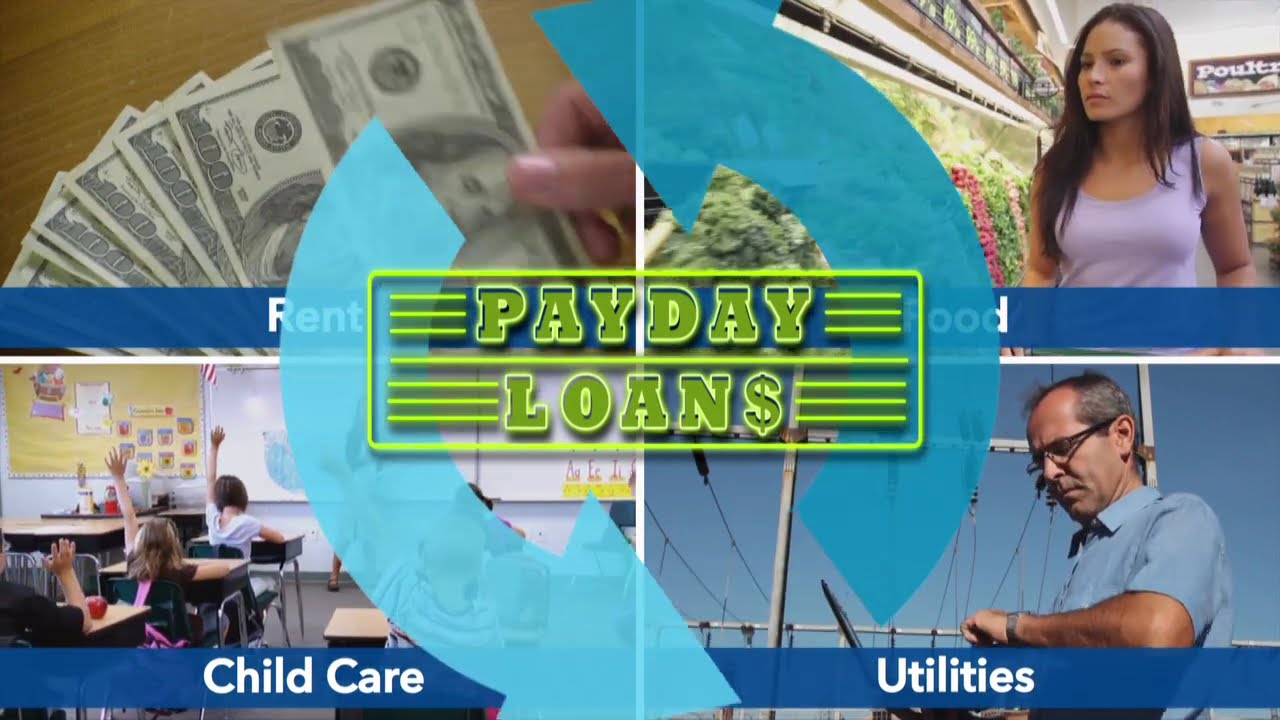

What ever the reason you require the lending, prior to you do anything, you need to comprehend the pros and also cons of cash advance finances. Payday fundings are little money financings that are offered by brief term loan lending institutions.

Below are the advantages that clients are choosing when obtaining cash advance. With these payday advance loan, getting money promptly is a feature that cash advance have over its standard rivals, that need an application and afterwards later on a check to submit to your bank account. Both the approval process as well as the cash money might deliver in much less than 24 hr for some candidates.

The Buzz on Quick Payday Loans Of 2022

Pay stubs as well as proof of employment are more vital to the authorization of your application than your credit history. Practically anyone with a consistent job can get a payday advance, after just responding to a handful of questions. These loan applications are additionally a lot more basic than standard options, leaving area for the consumer to be as personal as they need to be concerning their funding.

A quick online lender search will certainly trigger you to a variety of choices for little cash financings as well as quick cash advance. While there are numerous advantages and disadvantages of payday advance loan, online lending institution gain access to makes this choice a real convenience for those that need cash money quick. Some consumers delight in the privacy of the net loan providers that just ask very little inquiries, evaluate your income, and down payment cash money into your account quickly after you have actually electronically signed your contract.

A Biased View of Quick Payday Loan

Like all excellent finance choices, there are concerning features that stabilize out those attractive advantages. As easily accessible as something like a cash advance is, it can be something that is as well excellent to be true. Due to the clients that these short-term lending lending institutions bring in, Quick Payday Loans of 2022 the downsides can be additional damaging to these clients and also their financial states (Payday Loans).Some consumers locate themselves with interest rate at fifty percent of the finance, and even one hundred percent. By the time the financing is repaid, the amount borrowed as well as the rate of interest is a total of twice the original loan or even more. Since these prices are so raised, customers discover themselves not able to make the total repayment when the following check comes, furthering their financial debt and also straining themselves financially.

Some of these short term lending lenders will certainly include a charge for clients who attempt to pay their financing off early to eliminate some of the interest. When the cash advance financing is gotten, they anticipate the payment based upon when a person is paid and also not earlier in order to collect the interest that will be built up.

If the payday advance loan is incapable to be paid completely with the following check, as well as the balance has to roll over, the client can expect yet an additional charge that resembles a late charge, billing them more passion basically on the payday advance. This can be challenging for a household and stop them from being able to get in advance with a financing - Payday Loans.

What Does Quick Payday Loans Of 2022 Mean?

Lots of customers discover these payment terms to be ruining to their funds and also can be even more of a problem than the demand that created the first application for the loan. Often customers find themselves unable to make their cash advance payments and also pay their bills. They sacrifice their settlement to the payday advance business with the hopes of making the settlement later on.

When a debt collector gets your financial obligation, you can anticipate they will contact you often for payment via phone and also mail. Should the financial debt remain to remain, these collection companies may have the ability to garnish your incomes from your incomes up until your debt is collected. You can establish from the people specify regulations - Quick Payday Loans of 2022.

Report this wiki page